Why Your Stock Isn’t at Its Peak—and Why That’s FineInvesting in stocks can feel like a rollercoaster, especially when your picks aren’t hitting all-time highs. Here’s the reality: Most stocks trade below their peak most of the time, and that’s not a flaw—it’s a feature. Let’s break down why this happens, what it means, and how to think about it as a retail investor aiming for the long game.

Stocks Rarely Hang Out at Their Highs

Picture this: You buy a stock, it spikes to a record high, and you’re feeling brilliant. Then it dips. And stays there. For a while. That’s normal. Stocks don’t live at their peak—they hover below it more often than not. It’s not a sign of failure; it’s just how markets work. Prices reflect sentiment, news, and a million other variables, and those don’t align for constant highs.

The takeaway? Get comfortable with your stock sitting below its best day. It’s not about timing the top—it’s about the bigger trend. A stock can still be a winner even if it’s not breaking records every month. Patience beats panic every time.

New Highs Take Time—Sometimes a Lot of It

How long does it take for a stock to hit a new high? Longer than you might think. Years, decades, even centuries in extreme cases. Look at Amazon: It soared to $186 in 1999, then crashed during the dot-com bust. It didn’t reclaim that high until 2009—a full decade later. Today, it’s a titan, but those early investors had to wait through a brutal stretch.

Point is, the gap between peaks can be massive. Markets don’t owe you quick wins. If you’re chasing the next high, you might sell too soon and miss the real payoff. Amazon’s story isn’t unique—great companies often take the scenic route. Focus on the fundamentals, not the calendar.

Quarterly Results? Loud Noise, Small Impact

Every three months, the market goes nuts over earnings. A beat, a miss, a CEO’s offhand comment—stocks swing like pinatas. But here’s the math: A single quarter’s result is just a fraction of a company’s worth, roughly 3% of its total present value. Wall Street obsesses over the next 12 months, amplifying every report into a make-or-break moment.

For retail investors, this is a trap. That 3% matters for a few weeks, then fades. The real game is the extended trajectory—will this company still be crushing it in five years? Noise around quarterly results is just that: noise. Tune it out. Our earlier piece on 5 KPIs (Revenue, Profit, FCF, BVPS, ROIC) can help—check if those are growing 10%+ annually. That’s the signal in the static.

Uneven 20% Beats Steady 15%—Embrace the Volatility

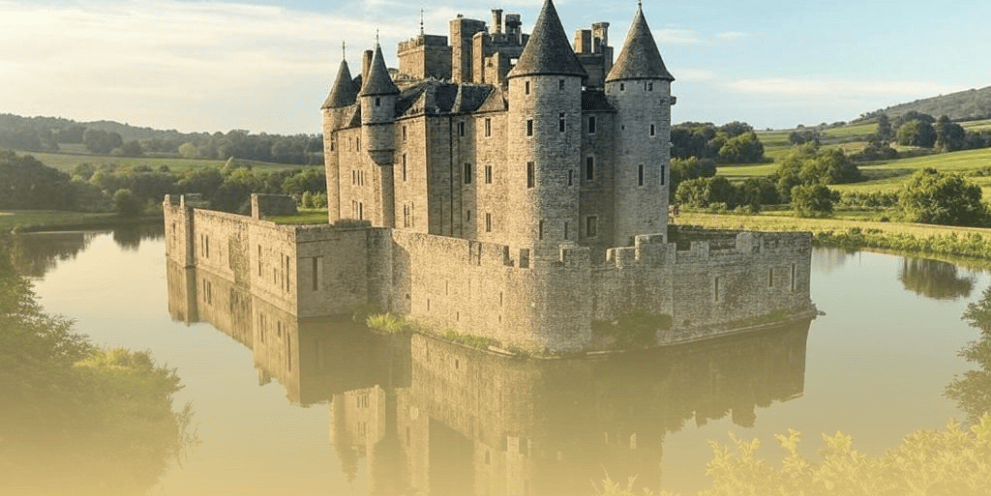

Here’s a head-scratcher: A stock that delivers an uneven 20% average return over time often outshines a smooth 15% one. Why? It’s about the moat—the competitive edge that shields a business from rivals. Think of it like a medieval castle’s moat: a wide, deep trench filled with water (or alligators, if you’re fancy) that keeps invaders away. In business, that moat might be a killer patent, a loyal customer base, or a network no one else can touch—say, Amazon’s logistics empire or Apple’s ecosystem.

Companies with strong moats can take hits, bounce back, and soar higher. That volatility—big dips followed by bigger gains—isn’t a flaw; it’s proof of strength. Take a tech giant with a rough year: A 30% drop, then a 70% rally. Average it out, and you’re at 20%. Compare that to a steady 15% utility stock—safer, sure, but less explosive. Don’t fear the swings if the moat’s intact. It’s the difference between a fortress and a sandcastle.

The Long View Wins

Most stocks won’t sit at their highs. New peaks might take years—or longer. Quarterly hype fades fast, and uneven returns can trump steady ones if the business is built to last. For retail investors, this is liberating. Stop chasing daily headlines or perfect timing. Dig into what matters: Is this company growing its core over decades, not quarters?

Amazon didn’t become Amazon by hitting highs every year—it did it by grinding through the gaps, moat and all. Your portfolio can too. Look past the noise, lean into the defenses, and let time do the heavy lifting.